Start taking control of your finances by incorporating these creative and practical bullet journal ideas into your daily routine. With the power of journaling, it’s never too late to get your financial affairs in order and start working towards achieving your long-term goals, whether that means saving up for a dream home, a new car, or even just a reliable laptop.

While digital tools are certainly useful for tracking expenses and staying on top of finances, there’s something uniquely satisfying about having a tangible plan laid out in front of you. And that’s exactly what these finance-tracking bullet journal ideas aim to provide – a simple yet effective way to stay organized and make better financial decisions.

So why not give one of these ideas a try?

Who knows, it might just be the nudge you need to start building up your savings and working towards a brighter financial future.

Saving Goals

Multiple saving goals require a strategic approach to accumulation. Visualizing progress by stacking coins with colored markers can be a rewarding experience. As the stack grows, so does motivation. The tactile satisfaction of watching the colors blend together is a great motivator to continue making progress towards your financial objectives.

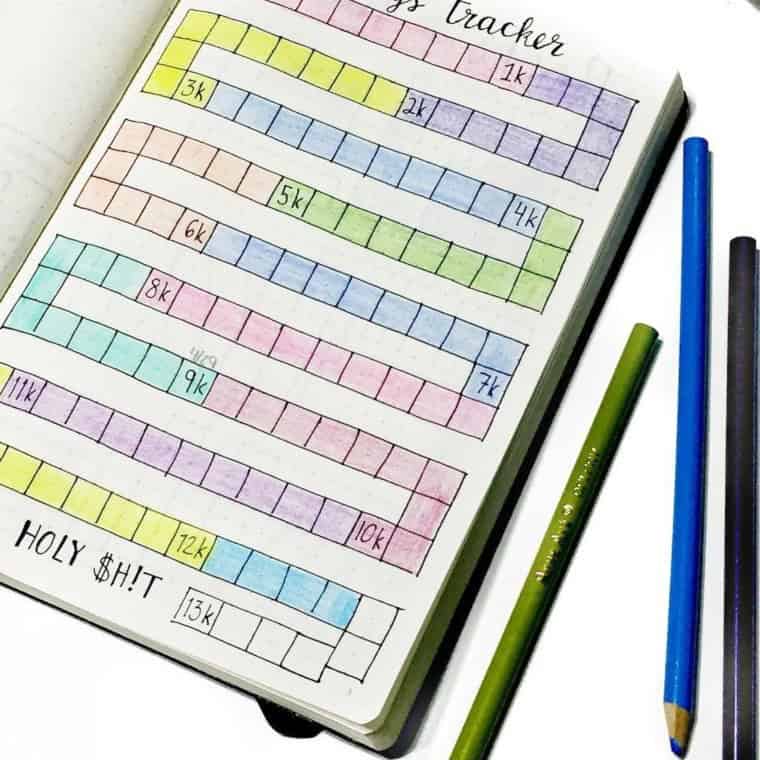

Savings Tracker

Elevating your savings game just got a whole lot more exciting! The thrill of the challenge lies in setting a specific financial goal, then meticulously tracking progress towards it. To make it even more engaging, consider visualizing your journey by color-coding squares as you hit key milestones – a tangible representation of your hard work and dedication.

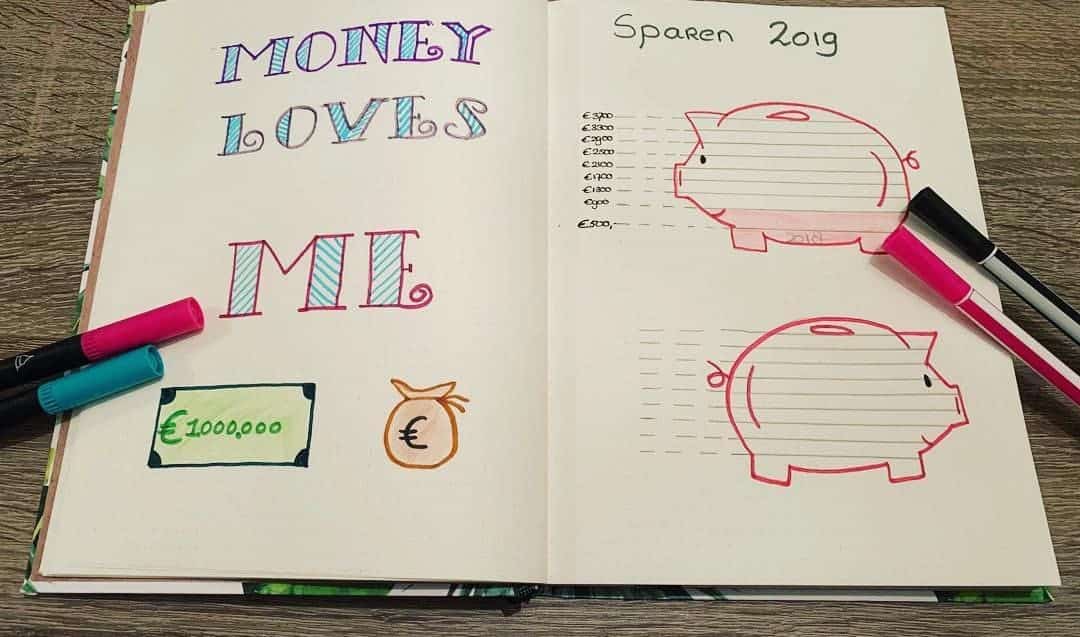

Money Loves Me

As advocates of the law of attraction often attest, the power of positivity can have a profound impact on one’s financial habits. By scripting optimistic affirmations, individuals can cultivate a mindset that fosters prudent decision-making and encourages responsible spending. In essence, setting lofty goals and committing them to paper can serve as a potent catalyst for transforming one’s relationship with money.

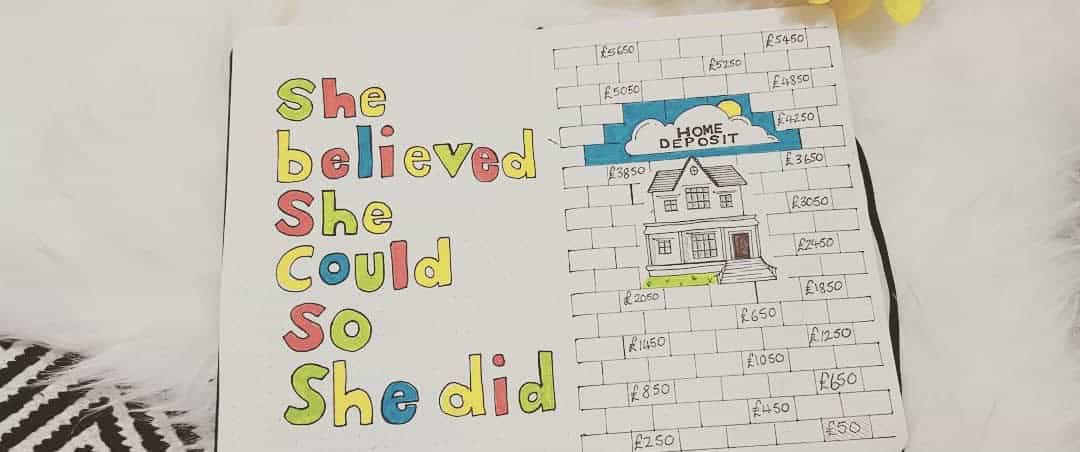

She Believed She Could So She Did

Wanting to save up for a home of your own but struggling to find the motivation? It’s not uncommon to feel stuck when it comes to making progress towards this goal. To help spark some inspiration, take a few minutes to jot down quotes that resonate with you, create a visual representation of your dream home, and start setting aside a small amount each month. Sometimes all it takes is a little boost to get the momentum going.

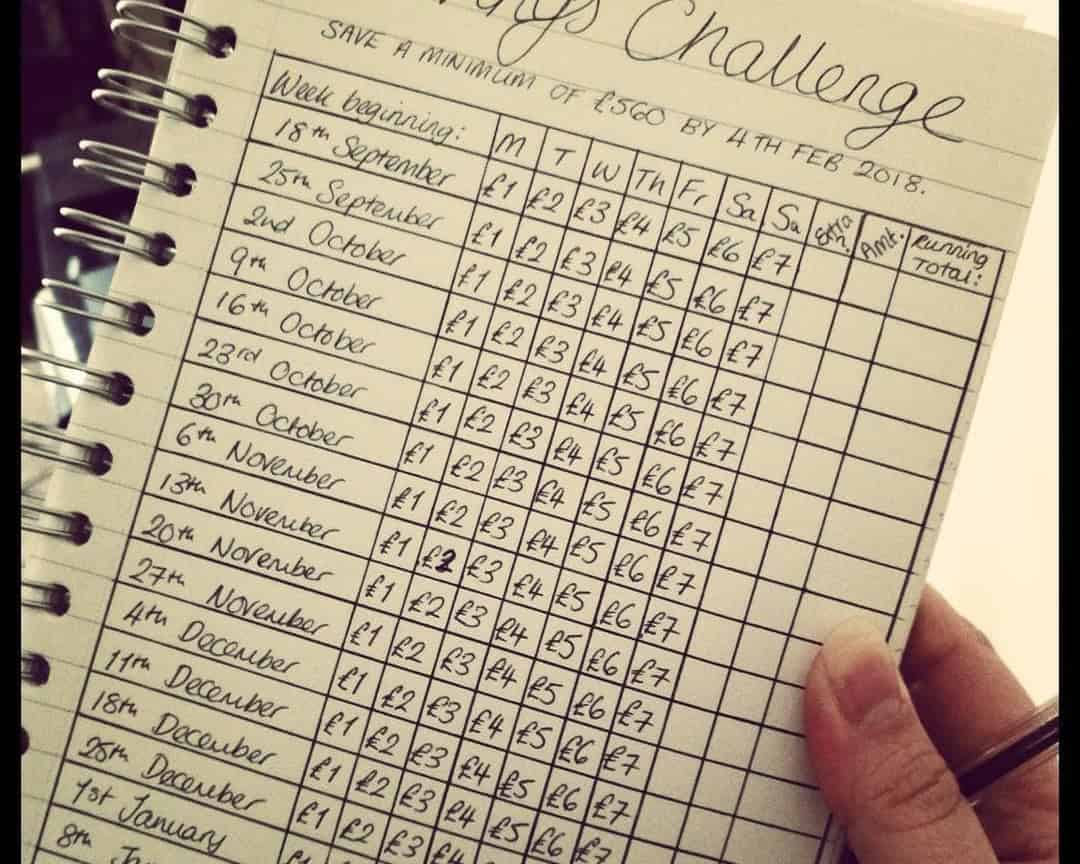

Savings Challenge

Begin by setting a daily savings goal, no matter how small it may seem. For instance, challenge yourself to save $5 one day, then increment that amount by $1 or $2 each subsequent day of the week. You might need to make some temporary sacrifices, like skipping a glass of wine with friends on the weekend, but the end result will be a significant sum added to your bank account.

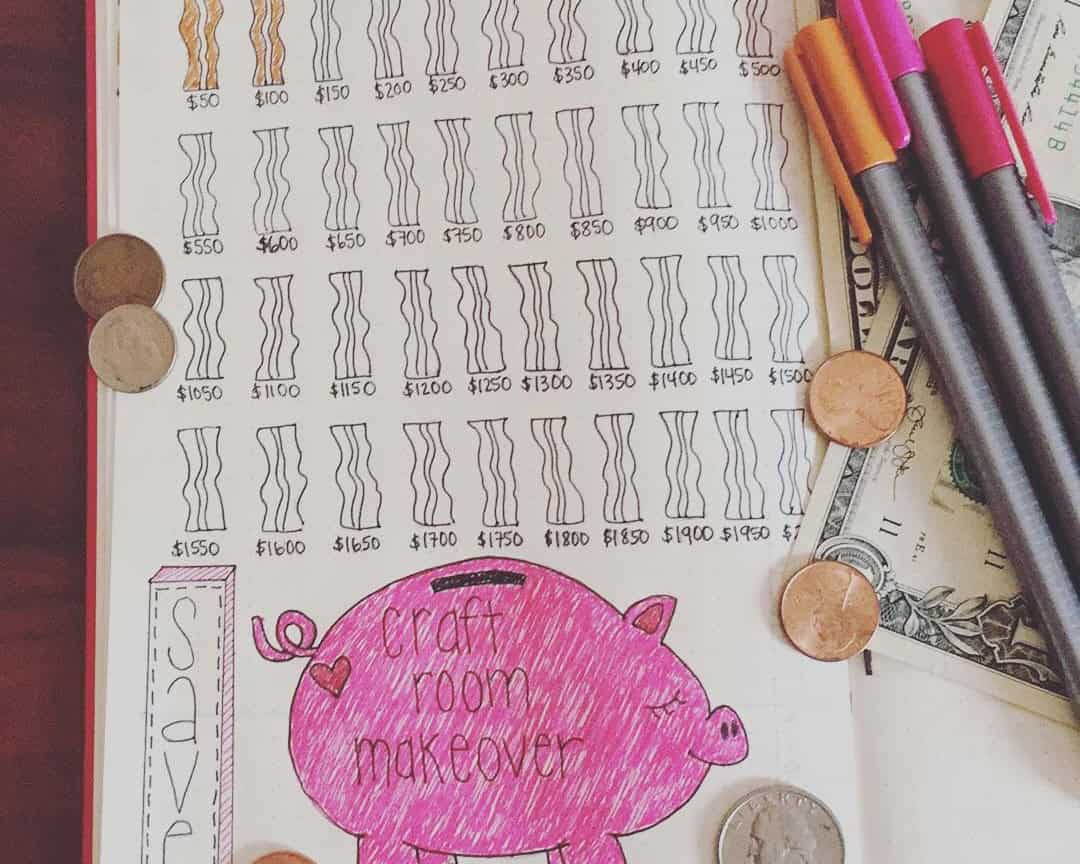

A Makeover

Renovating can be an exciting yet daunting task. To make your dream a reality, start setting aside funds today and approach the process with creativity. I’ve had a blast working with this template concept, and fellow food enthusiasts will likely appreciate its unique charm as well.

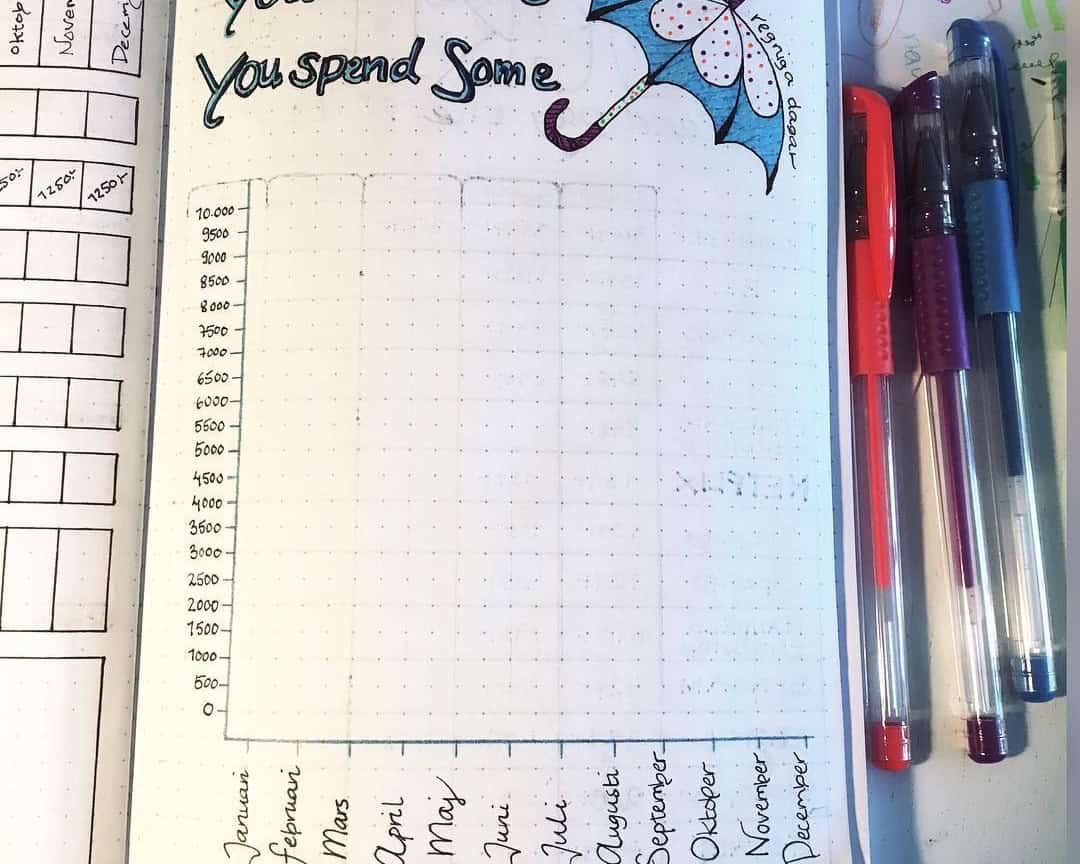

You Save Some, You Spend Some

By generating your own graphs, you’ll gain a deeper understanding of your monthly expenses and even be able to track your savings progress. This visual approach can provide valuable insights into how your spending habits change throughout the year. For instance, you might notice that certain periods, such as holidays, tend to lead to increased expenses, leaving you with less disposable income.

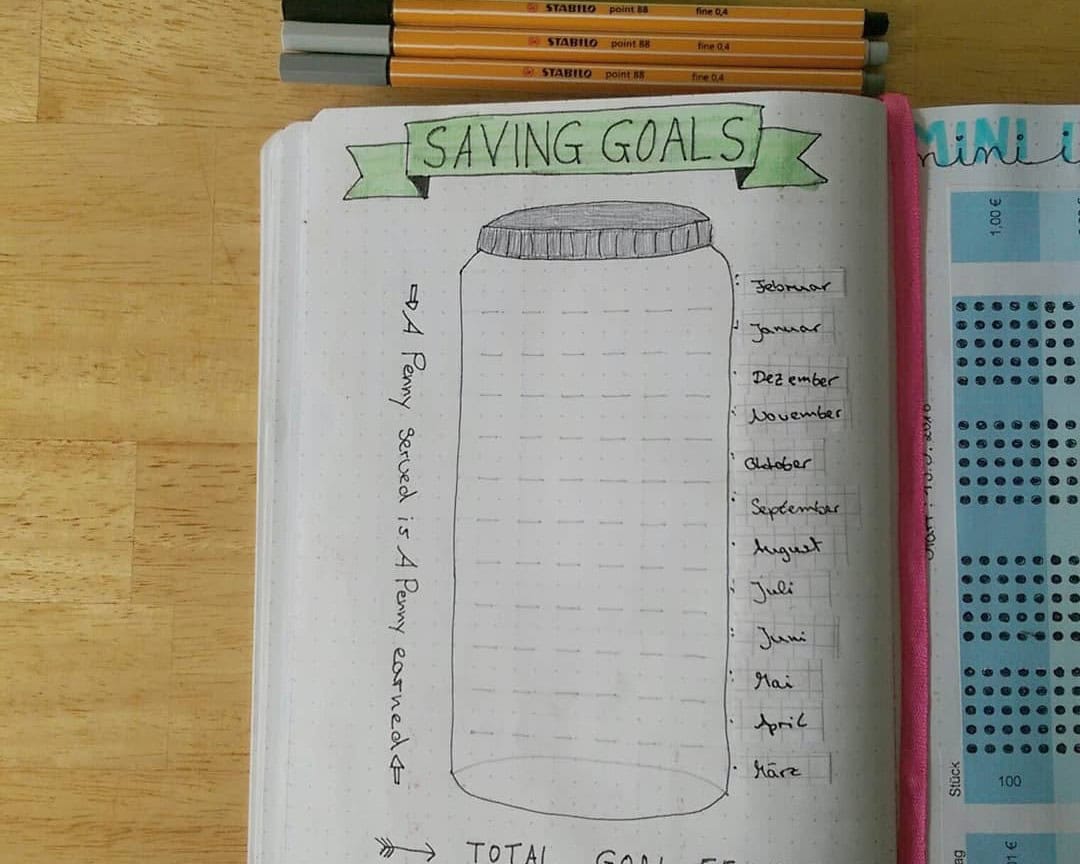

Saving Goals

The concept of using a physical jar to save money is not new, where individuals would deposit spare change as it accumulated. Similarly, you can apply this principle to your bullet journal by creating a virtual ‘cash jar’ for yourself. This way, you can still cultivate the habit of saving money digitally.

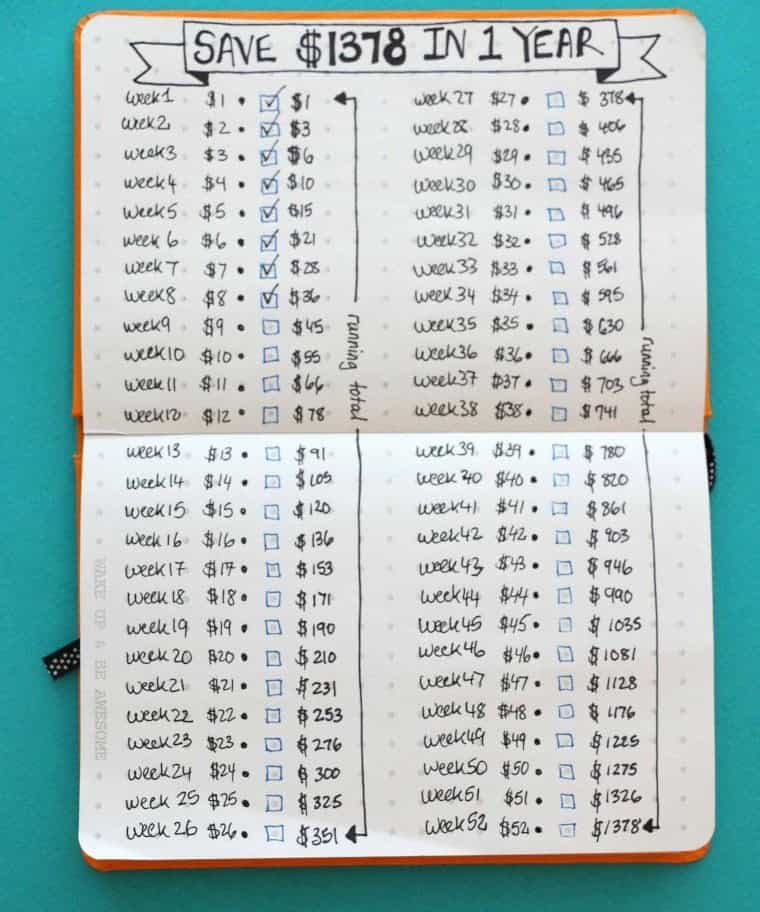

Save $$ In 1 Year

Taking the first step towards financial growth can be as simple as setting aside an additional $1 each week. This incremental approach allows you to ease into the habit of saving and provides ample opportunity to brainstorm innovative ways to boost your income. The challenge itself is rewarding, and the cumulative effect can lead to a substantial sum over time.

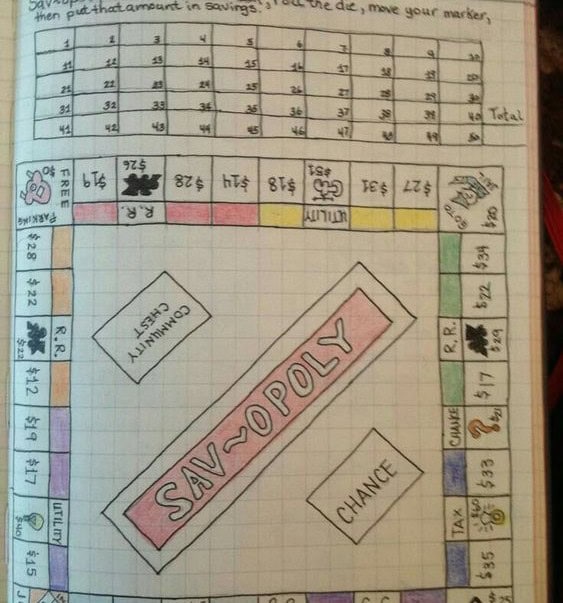

Sav-opoly

For fans of the classic board game Monopoly, this template offers a unique way to turn saving money into a fun and engaging experience. By adopting a similar approach, you can transform what might typically be a mundane task into an enjoyable game that rewards your efforts with tangible benefits – in this case, actual monetary gains.

Where Does All My Money Go?

If you’re prone to overspending and deep down, you know it’s a habit you’d like to break, this template is sure to resonate with you. The question is, where does your hard-earned cash actually disappear to? One effective way to gain insight into your spending habits is by utilizing the power of colors. By doing so, you may be surprised to discover that you’re allocating an inordinate amount of money towards items that don’t necessarily bring you joy or serve a higher purpose.

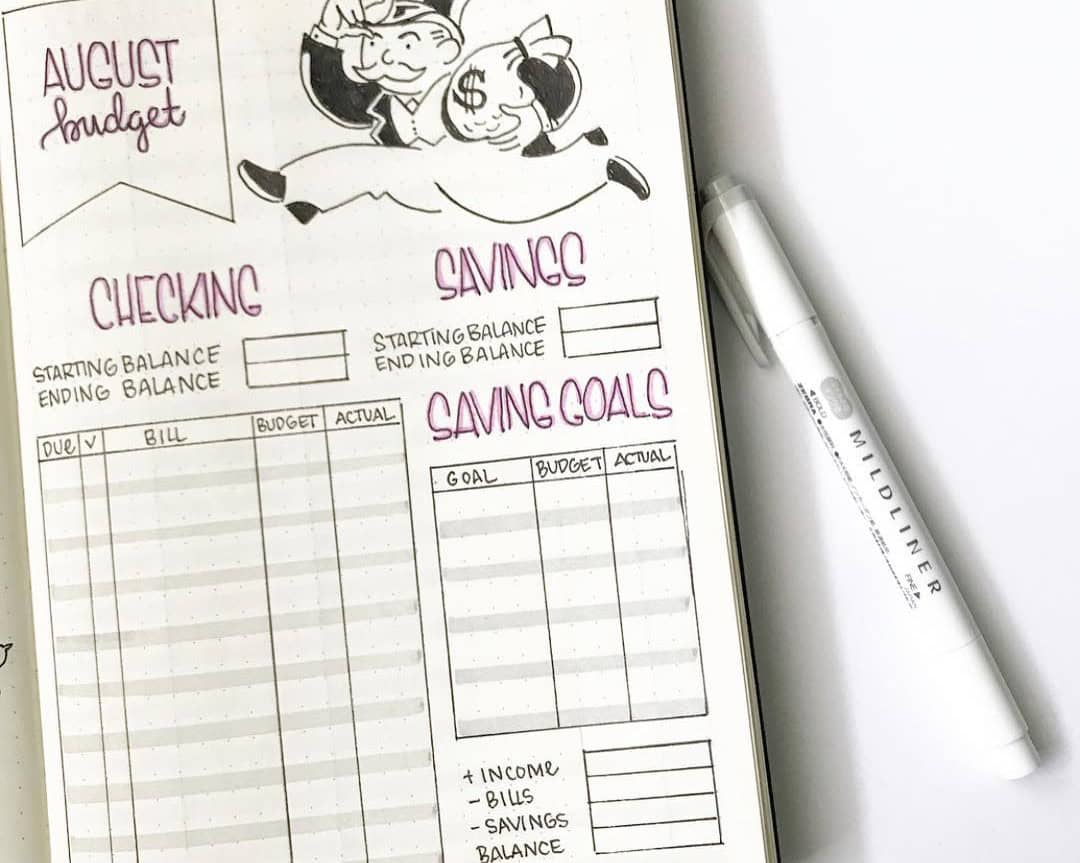

Budget Budget Budget…

While commencing a savings journey, it’s crucial to identify your current balance and use that as a benchmark for progress. The sense of accomplishment that comes from watching your balance grow exponentially, far surpassing its initial value, is unparalleled.

The Colorful Approach to Finances

The template’s color palette truly stands out for me. Notably, its design concept echoes that of many other templates I’ve seen. What sets it apart, however, is the thoughtful incorporation of various patterns. This encourages users to experiment with multiple hues, fostering a sense of creative freedom.

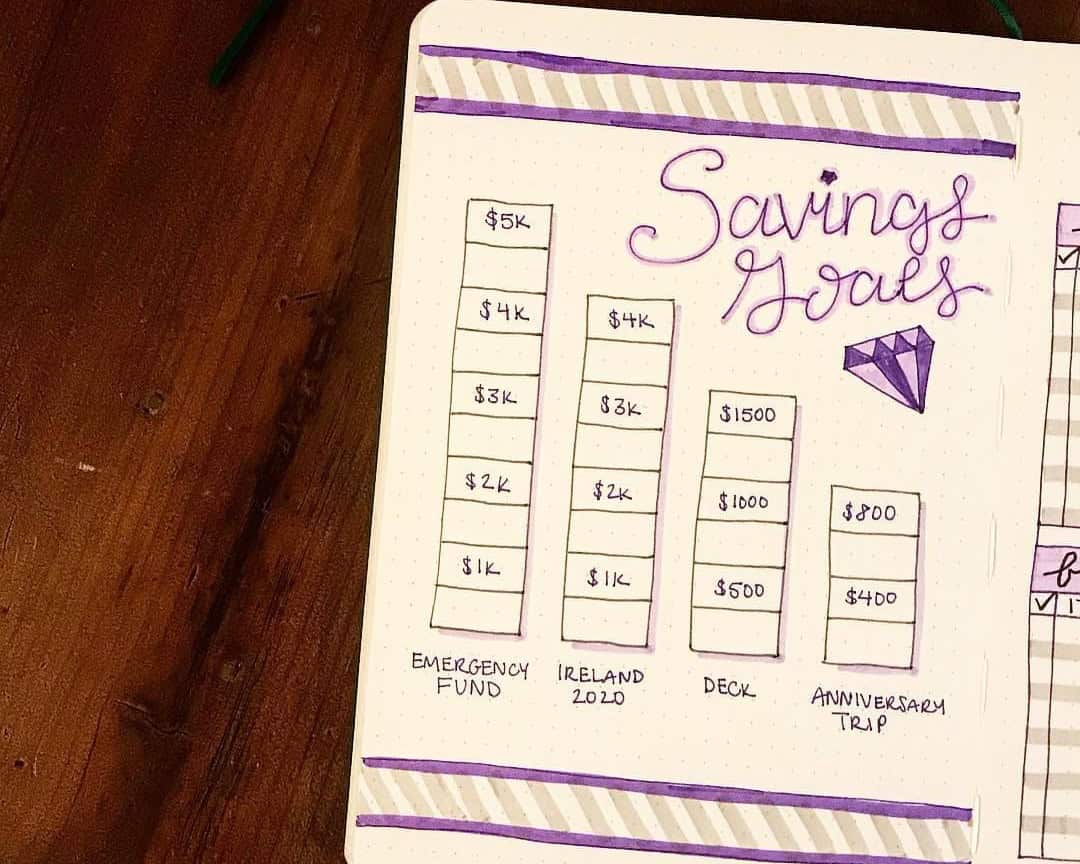

Savings Goals

To maximize your savings, identify your top financial priorities and tackle them head-on. Focus on filling out the most critical budget categories first, such as rent/mortgage, utilities, and essential expenses. This template allows you to simultaneously allocate funds for multiple goals, giving you a clear picture of where your money is going.

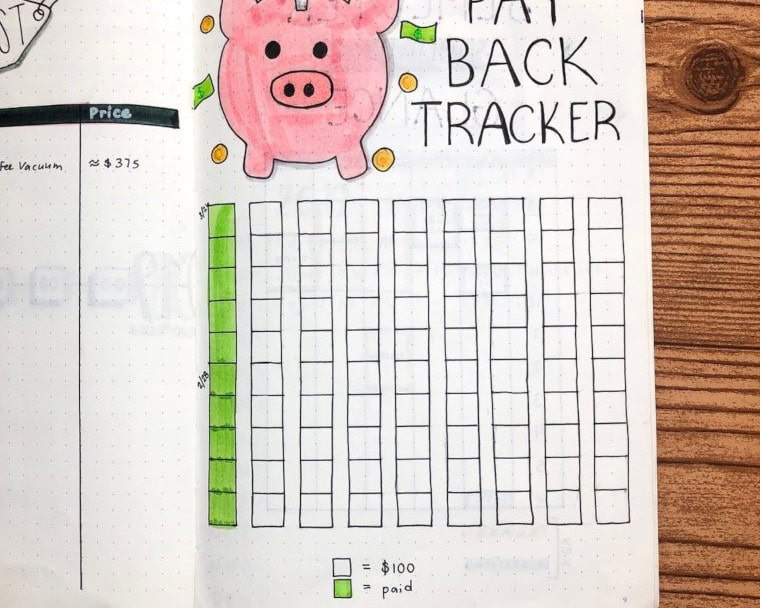

Pay Back Tracker

Get started on tackling debt by tracking your daily payments. Visualize progress by creating a grid with equal-sized squares, each representing a specific amount. Fill in as many squares as needed to see the impact of consistent repayment. Once you’ve cleared your debts, consider redirecting those funds towards long-term goals, such as planning a dream vacation or saving for a new home.

House Goal

Consider transforming your savings goals into a creative visual representation, such as drawing a house or car each month, with the added twist that it gets progressively more vibrant and detailed as you reach milestones. This unique approach not only fosters enthusiasm for saving but also serves as a tangible reminder of your progress towards achieving something significant.

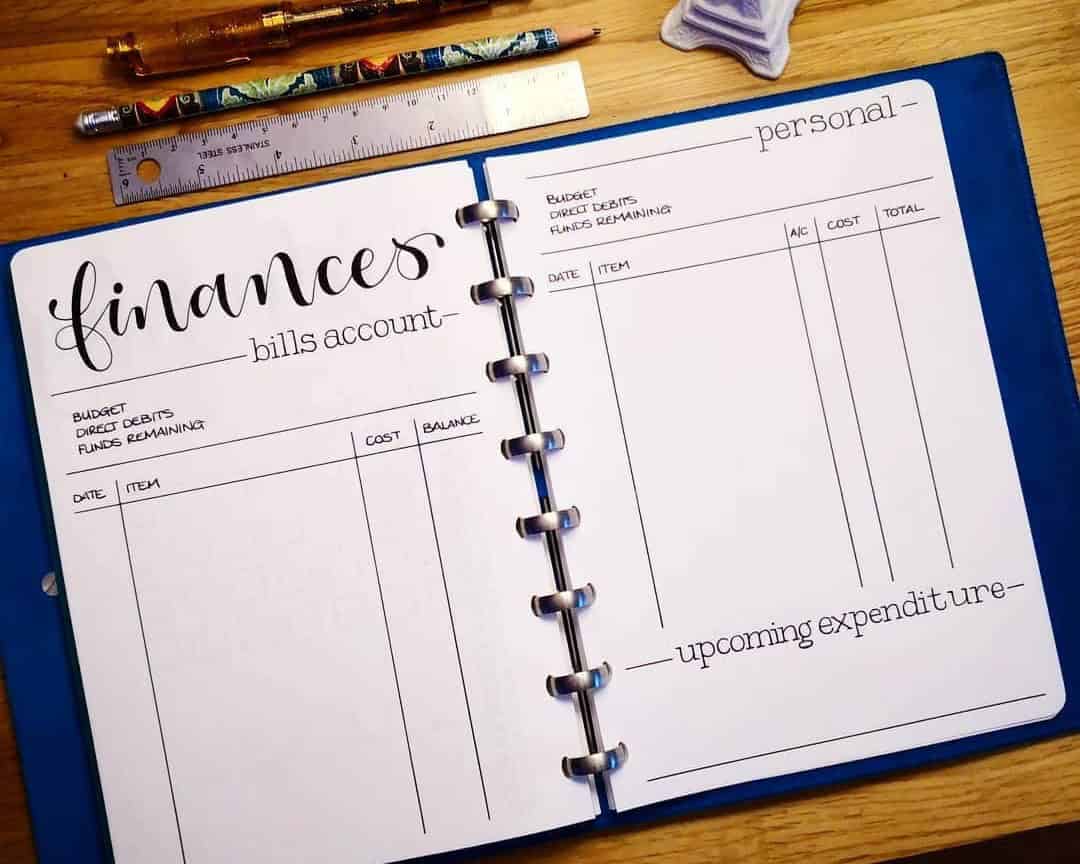

Finance Bills Account

For those who prefer a streamlined approach to bullet journaling, simplicity can be a powerful tool. By embracing minimalism, you can create beautiful and functional spreads using only a few basic tools – in this case, a black pen is all you need. Take it a step further by mastering a new font to add a touch of sophistication to your financial record-keeping.

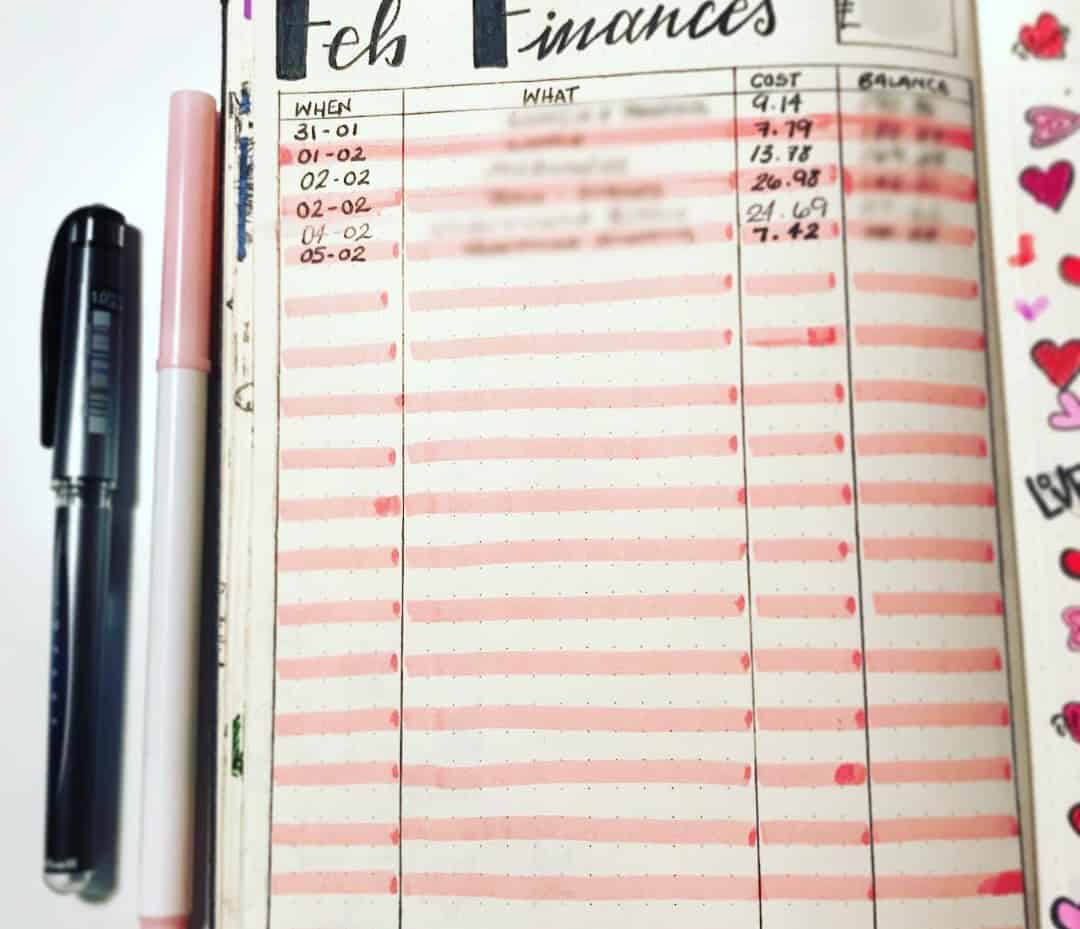

Your Finances

Keeping track of your finances can have a profound impact on your ability to save money. One simple yet effective approach is to note down your balance every time you make a purchase. This habit not only provides a clear picture of your financial situation, but also offers an opportunity to hone your math skills. By having a tangible understanding of your account’s current state, you’ll be better equipped to make informed decisions about how and when to allocate your funds.

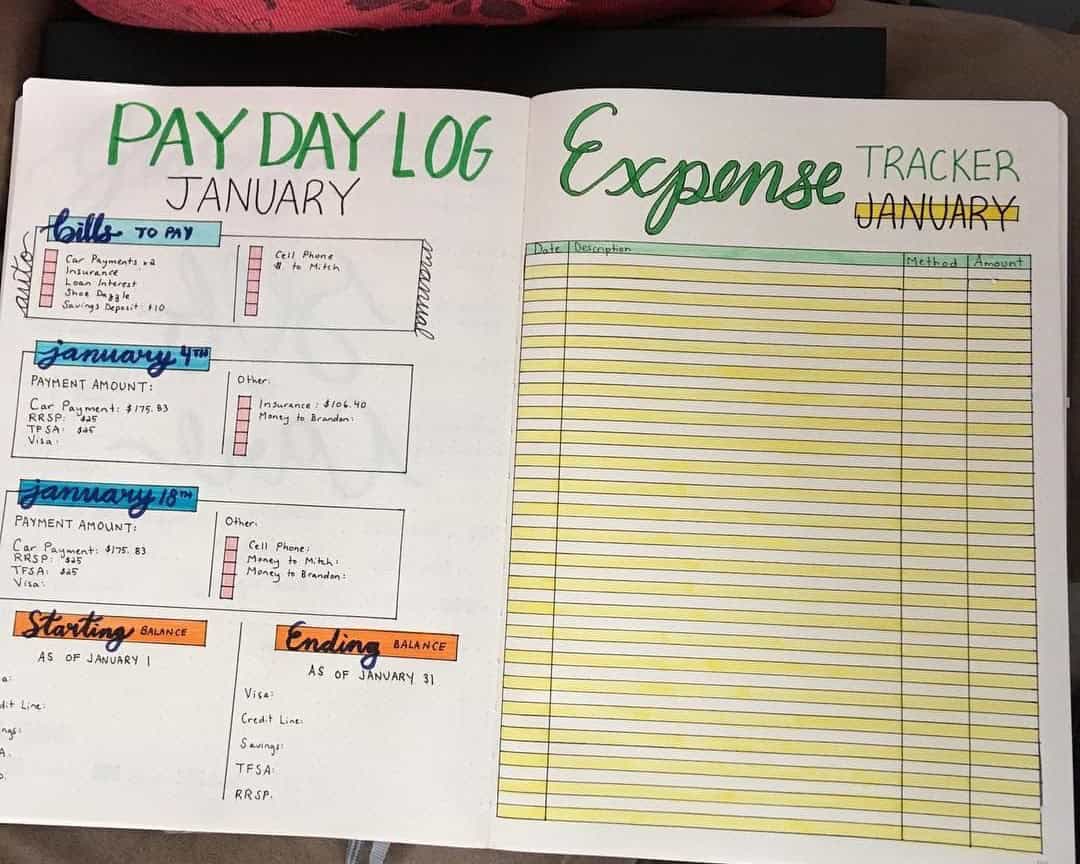

Pay Day Log and Expense Tracker

To maintain a clear financial picture, it’s essential to meticulously log all income, particularly if you’re a freelancer who receives multiple payments each month. Moreover, track your bills and expenses to ensure seamless management of your finances. A straightforward bullet journal template can serve as a reliable guide, making it easy to stay organized.

Categorize Expenses

It’s essential to have a grasp on how your money is being allocated, covering essentials like clothing, food, and bills. This awareness can help you pinpoint areas where adjustments could be made to free up more funds for saving or investing.

Take a closer look at your spending habits – are you indulging in pricey fashion or frequent dining out? By grouping your expenses into categories, you’ll gain valuable insights that can inform smarter decisions about your financial future.